Below are the October articles of interest from key trade publications, with excerpts highlighting...

How Modern Brand Strategies are Affecting the Agency Landscape (Pt 2)

This is the first article in a series of excerpts from our paper on How Modern Brand Strategies are Affecting the Agency Landscape. The article discusses business-to-consumer companies’ brand portfolio strategy trends, its effect on the creative agency industry, and how you should reflect those in your agency sourcing strategies.

Age of Consolidation Profit & Efficiencies

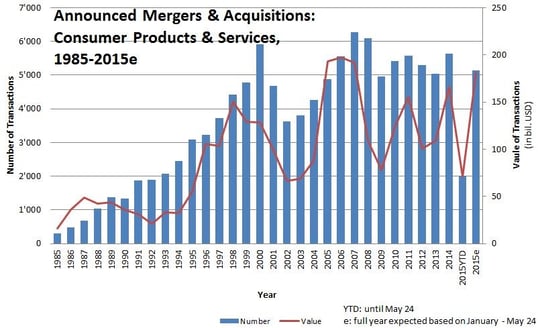

The age of business diversification has ended and a new age has begun. The Mergers and Acquisitions (M&A) activities of past few years lead to a better understand of this shifting business environment that became more focused at consolidation, profit maximisation and efficient operations at a global scale.

Source: IMAA

According to the IMAA data, one can see the expected massive dip in the M&A activities between 2007 and 2008, due to the effects of the Global Financial Crisis. Although M&A activities started to gain traction again in 2010/11, they went back to activity levels seen in 2008 during 2012/13. It’s also clear that since 2014, there is a substantially increased value of M&A activities, and 2015 is projecting to reach the pre-Crisis M&A levels.

Increase in the M&A activities since 2014 of Consumer Products & Services companies confirms the trend of businesses seeking increases in revenue and profit through utilisation of economies of scale and efficiencies. We will look at examples of some of the biggest M&A and Brand Rationalisation activities to further illustrate trend of optimisations of Brand portfolios of some of the world’s leading B2C companies.

As a first example, let’s look at Unilever’s recent strategy. Unilever has been through many brand rationalization programs and divestments in past few decades, with most focus being given to this strategy since 2009, when Paul Polman was named CEO. As of today, this strategy has been further accelerated in order to deliver further optimisation of Unilever’s brand portfolio and optimisations we see today are going to continue.

Another example is when Kraft split itself in two to create more focused and independent companies. This was done to provide better focus to each company and to separate brand portfolios for the newly established companies (Kraft and Mondelez) to enable each to clearly position theirs. To enable this strategy, Kraft had also bought Cadbury ahead of this split to strengthen its snack foods portfolio for its new Mondelez entity. Later in 2014, Mondelez further rationalised its brand portfolio through the sale of its coffee business to the D.E.Master Blenders (while still retaining minority stake in this new entity).

Most recently, P&G followed suit as it spun-off its beauty portfolio to Coty. This is a key step for P&G to ultimately divest as many as half of their brands as part of the revitalisation plan launched by their CEO A.G. Lafley in 2013. And there are many more examples such as Wrigley’s acquisition by Mars.

It is clear from the examples above that the strategy of the whole industry is shifting. Looking at this shift closely, there are some consistent patterns emerging. When purchasing, the focus is on building scale and efficiencies (Operations, Distribution as well as Marketing). When selling, the key goals are divestment of less profitable brands and those that cannot take advantage of core operational efficiencies.

Focus, efficiency and optimisation are the buzz-words of today’s corporate strategies. More complexity means more expensive supply chain systems and processes, higher retail costs (listing fees, negotiations over more prices/promotion) and finally more internal costs (marketing, support functions etc.).

Complex, unfocused businesses are not well-suited for survival in today’s world.