Adweek not long ago highlighted the 50 year relationship between Publicis Groupe’s Leo Burnett and...

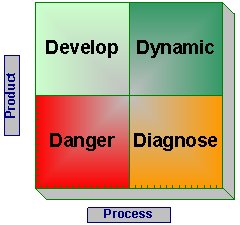

The Agency Management Relationship Matrix

This article introduces a tool we use to map agency performance - the Relationship Matrix.

The Relationship Matrix helps clients visualize the two key dimensions that all agencies must deliver on - Product and Process.

This is a powerful tool to deliver deep insights into performance, quickly. As such, it's a terrific "C" level report.

Agency Management is More than a Number

With formal evaluation programs it is very easy to get caught up in the final, overall rating score.

However, it's also very useful to dig deeper into the data to understand how that overall score was determined.

The Relationship Matrix helps clients better understand where the strengths and weaknesses of their suppliers are. Then they can develop strategies based on those understandings.

Agency Performance Dimensions

In the Relationship Matrix we label the two dimensions "Product" and "Process".

The Product dimension is what the agency / supplier actually does and relates to the craft or output that they deliver.

As an example, in advertising this would include such aspects as strategic insights, creative ideas and customer understanding. In strategic supply it might address the quality of a product, innovation and delivery.

The Product in an agency context has been referred to as the 'Magic'.

The Process dimension is how the agency / supplier does it and relates to the way in which they provide their goods and services.

Examples of this would be project management, financial administration and account service.

In an agency setting, this has been referred to as the 'Logic.

For more on Magic and Logic see the ISBA / CIPS / IPA Whitepaper 'Magic and Logic: redefining sustainable business practices for agencies, marketing and procurement' .

Agency Management Mapping

Where do your key agencies or suppliers fit on this Relationship Matrix?

Using these dimensions we can segment agencies / suppliers into 4 key sectors. Potentially, clients can develop different strategies to address each group. Hopefully, very few of your portfolio are in the final segment!

- Dynamic: Strong on both “Product” and “Process”

Your ideal partner. Learn from what they do and build best-practice models to leverage across others in your portfolio.

- Develop: Strong “Product” but weak “Process”

They are good at what they do but can be a nightmare to work with as their processes are inefficient. Help them to identify and improve the areas that are causing you concern.

- Diagnose: Strong “Process” but weak “Product”

This is a difficult segment, as suppliers may be easy to deal with and incredibly efficient, the issue is that don't deliver what you are actually paying them for. Diagnose quickly what the problems are as they can have a major negative impact on your business.

- Danger: Weak on both “Product” and “Process”

The big question here is whether you should continue to work with anyone in this segment. Is it worth having to not only improve their processes but also to address the critical problems they have with their outputs?

Author: Richard Benyon (Decideware)